An introduction to MODO : David Hockney's consistent appreciation provides an increase in sales of 54% on last year.

Hockney’s Exceptional Market Strength:

In the last couple of years Hockney not only weathered an art world downturn but led a resurgence. That kind of performance sets him apart as a key cultural and economic asset to the UK art sector.

David Hockney remains one of the most reliable and compelling names in the contemporary art market—an artist whose work consistently appreciates in value and whose versatility spans generations of collectors. With auction records reaching over $90 million and sustained demand for his paintings, prints, and digital works, Hockney represents a rare blend of artistic legacy and market dynamism. For both corporate art collections and private investors, Hockney’s work offers not only cultural and aesthetic capital but long-term financial value. His prints and editions provide accessible entry points for new collectors, while his iconic paintings command blue-chip status with proven return on investment.

In a volatile economic landscape, his consistent performance across market segments makes him a cornerstone for any forward-thinking art acquisition strategy.

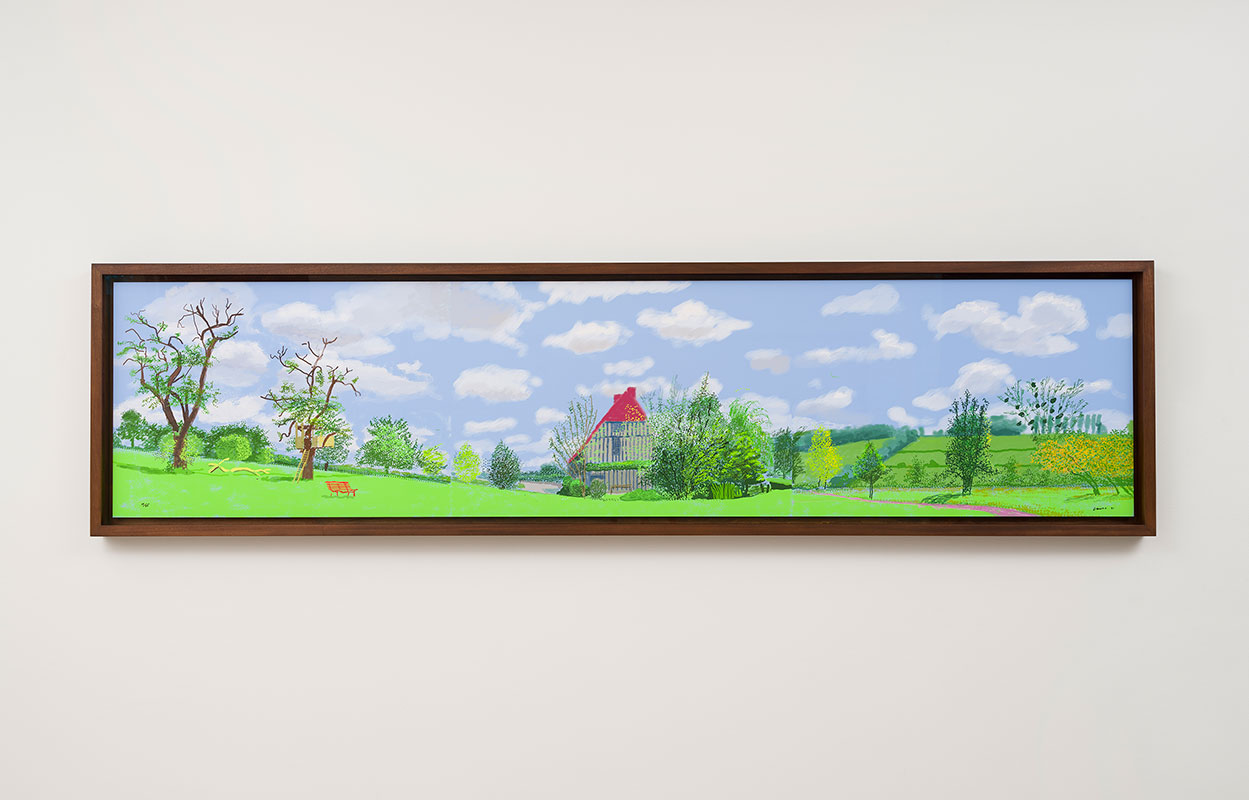

Positioned at the heart of this thriving market is MODO, a specialist contemporary gallery based in Cambridge that has built a distinctive reputation through its deep focus on David Hockney’s oeuvre.

MODO is not only a space for viewing and acquiring works—it is a hub for education, advisory, and connection. With a sister gallery in London’s prestigious Piccadilly Arcade, MODO has access to a strong network of recurring buyers, seasoned collectors, and respected dealers, MODO offers unmatched insight and market access for those looking to build meaningful collections. Whether advising companies on corporate acquisitions to enhance their workspaces or guiding private collectors through bespoke investments, MODO is rapidly becoming the go-to gallery for all things Hockney. Its curated approach and market expertise make it an essential partner for anyone looking to invest in art with both confidence and purpose.

Art Market Influence:

David Hockney stands as one of the most commercially successful British artists. In 2018, his painting Portrait of an Artist (Pool with Two Figures) sold for $90.3 million (£70 million), setting a record at the time for the most expensive artwork by a living artist.

His market has experienced significant growth over recent years. Between 2017 and 2022, the average sale price of his works increased by 87%, with a compound annual growth rate of 13%. In 2022 alone, his artworks achieved a total turnover of €141 millions. In the last couple of years Hockney not only weathered an art world downturn but led a resurgence. That kind of performance sets him apart as a key cultural and economic asset to the UK art sector.

Cultural and Institutional Impact:

Beyond direct sales, Hockney’s influence permeates the cultural landscape. His exhibitions, such as the 2017–2018 retrospective at Tate Britain, attracted over a million visitors globally, boosting tourism and associated economic activity. Currently the Louis Vuitton Foundation, Paris are holding Hockney 25, his largest exhibition to date.

Institutions like the British Council and the Royal Opera House have featured his works prominently. Notably, the Royal Opera House sold Hockney’s Portrait of Sir David Webster for £12.8 million in 2020 to mitigate financial challenges during the COVID-19 pandemic.

Broader Economic Contributions:

Hockney’s success has broader implications for the UK’s creative industries. His prominence enhances the global reputation of British art, encouraging investment and interest in UK-based artists and institutions. While precise figures are elusive, his role in elevating the UK’s cultural profile and stimulating economic activity in the arts sector is undeniable.

In summary, David Hockney’s contributions to the UK economy are multifaceted, encompassing direct art sales, cultural tourism, and the bolstering of the nation’s global artistic standing. This is why David Hockney’s work is used a basis for the educational programmes run within MODO by Art and Culture Education CIC.

ACE CIC was founded to address the issues surrounding Art as a serious subject within schools and the bias witnessed by students, teachers and parents when navigating the art education process. The creative industries contribute over £49 billion in gross value added and generate over £140 billion in total annual revenues. The sector fuels innovation, exports and employment across the country. Yet despite this Art education remains under valued, with fewer and fewer students encouraged to pursue creative subjects due to systemic bias and outdated assumptions about their worth. This disconnect risks weakening one of the UK’s most powerful economic engines. MODO and ACE C.I.C undersand the value of art is much deeper and multifacited than the commercial figures we get from sales reports.

Strong Market Presence:

The value and demand for David Hockney's work has not fluctuated in recent years as suggested by some market reports. The figures are purely based on auction sales, which is not an overall market appraisal. For instance the use of other online platforms to sell and buy artwork, leading to the issues seen at top auction houses like Sotherbys, Christies & Phillips who have reported massive decreases (cerca. 50% average) in sales over the last 2 years.

As a gallery dealing with private sales, we have seen a highly significant increase in private sales, and a lack of artwork for demand, sellers simply do not need to use auction houses to find a buyer, demand is extremely stong. The only figures available to make assumptions on the market are from auction houses and do not include private sales, gallery sales or other online platforms, which, is where the majority of sales are happening, fast and with huge appreciation. With no signs of slowing, quite the opposite, demand remains extreamly high, Collectors, Museums and Investment funds remain acutely focused on David Hockney’s work.

Figures Speak for Themselves:

In 2024, Hockney’s market experienced a substantial resurgence, with auction sales totaling $152.6 million—a 54% increase compared to the previous year. This is not expected to drop off, the market demand for Hockney work is especially high, his sales trajectory is stronger than any other artist and shows no sign of faltering.

Art Market Context For Hockney:

Major art auction houses faced notable challenges in 2024. Christie’s reported a 22% decline in auction sales during the first half of the year, totaling $2.1 billion, down from $2.7 billion in the same period of 2023. Similarly, Sotheby’s experienced a significant drop in core earnings, with reports indicating an 88% decrease, alongside substantial layoffs and concerns over its debt levels. This shows major strength in David Hockney’s market, when you compare the broader auction house struggles with Hockney’s performance, a few compelling points stand out:

1. Hockney’s Market Resilience vs. Auction House Decline

-

While Christie’s and Sotheby’s both saw major declines in auction revenue in 2023–2024 (Christie’s down 22%; Sotheby’s earnings down 88%), Hockney’s sales actually surged in 2024, reaching $152.6 million, up 54% from the previous year.

-

That contrast suggests Hockney’s work is defying broader trends, continuing to attract top-tier collectors even as the rest of the high-end market cooled.

2. Selective Confidence in Blue-Chip Artists

-

The data reinforces that collectors are still willing to spend significant amounts, but they’re being more selective—focusing on artists with proven long-term value.

-

Hockney, being a global icon with cultural as well as market weight, benefits from that trust. He becomes a “safe haven” in times of market uncertainty.

3. Hockney’s Market is Bigger Than Auctions Alone

-

Add to this the increase in private sales of Hockney’s work, and the actual demand being even higher than auction numbers show.

-

Galleries and collectors are trading his pieces behind the scenes, without the need of auction houses.

4. Institutional Confidence

Conclusion:

This comparison clearly highlights Hockney’s exceptional market strength. While much of the art world struggled over the last couple of years, Hockney not only weathered the downturn but led a resurgence. That kind of performance sets him apart as a key cultural and economic asset to the UK art sector.